The cargo delays hitting some European firms due to Pink Sea ship assaults must be short-lived as container carriers and their prospects regulate logistics plans to deal with the longer journeys, executives with one of many world’s greatest port operators stated.

Article content material

(Bloomberg) — The cargo delays hitting some European firms due to Pink Sea ship assaults must be short-lived as container carriers and their prospects regulate logistics plans to deal with the longer journeys, executives with one of many world’s greatest port operators stated.

“We don’t see in the meanwhile that this can be a quantity drawback – it’s a delay drawback,” Tiemen Meester, group chief working officer for ports and terminals with Dubai-based DP World, stated in an interview Monday. “There’s a non permanent dent into this circulation, however it would catch up.”

Commercial 2

Article content material

Article content material

Crusing south of Africa provides 10 to 12 days to the journey between Asia and Europe in contrast with the Suez Canal shortcut, and lots of the vessels that diverted final month have arrived in European ports in latest days. Because the mass detour enters its second month, supply schedules ought to begin to clean out.

“For just-in-time folks, there is a matter as a result of they should have 10 to 12 days extra stock,” stated Beat Simon, DP World’s group chief business officer for logistics. “As soon as they’ve that, the circulation will proceed.”

Japanese carmaker Suzuki Motor Corp.’s solely European plant, positioned in Hungary, stated Monday it’s suspending manufacturing Jan. 15-21 due to provide disruptions linked to the Pink Sea. That adopted related idling bulletins by Tesla Inc.’s Mannequin Y plant close to Berlin and a Volvo Automotive AB facility in Belgium.

The newest disruptions underscore a significant conclusion in a report DP World launched on Tuesday — that geopolitical forces are remodeling the worldwide financial system, rewiring worldwide commerce in costlier methods, and rising the necessity for provide chains to diversify and improve with higher expertise.

Article content material

Commercial 3

Article content material

Learn Extra: Sunak Says UK Needs to De-Escalate Tensions within the Pink Sea

On Monday, Houthi militants hit a US-owned business vessel with an anti-ship ballistic missile, underscoring warnings that one of the crucial important arteries for seaborne commerce stays too dangerous for navigation.

Talking from Davos, Switzerland, the place the World Financial Discussion board is happening this week, Meester made a distinction between the widespread supply-chain snarls that gripped the world financial system in the course of the pandemic and the present strains. “This not the identical, as a result of it’s particular trades,” he stated.

Quantity Rebound

He stated the route most affected by the vessel diversions is Asia to northern Europe, although some US-bound ocean freight additionally transits the Suez Canal and may very well be delayed.

On Monday, the the European Union’s financial system chief stated the Pink Sea tensions might begin to have an effect on power costs and inflation.

The worst-hit pocket for delays given the space round Africa is the japanese Mediterranean area at ports comparable to these in Turkey. There, volumes dropped “very, in a short time” within the early days of the Houthi assaults however are “again now — it has caught up, the 2 to a few weeks of stock,” Meester stated.

Commercial 4

Article content material

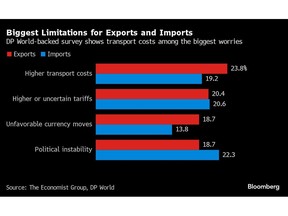

Nonetheless, importers and exporters face delays and added prices at a time when transportation bills and geopolitical dangers already are excessive on the listing of worries for worldwide firms in 2024, in response to a report launched Tuesday by DP World.

“A panorama of heightened geopolitical threat is unmistakably shaping the contours of world commerce,” the report titled “Commerce in Transition” said. “With escalating commerce tensions between the US and China, conflicts such because the conflict in Ukraine and, extra not too long ago, the conflict in Gaza, companies are more and more compelled to reassess their partnerships and supply-chain methods.”

DP World handles about 10% of world items commerce with operations in some 75 international locations. It not too long ago introduced plans to spice up investments in India and in Tanzania’s Dar es Salaam Port.

The report lays out three hypothetical eventualities for example how commerce is likely to be reworked:

- Within the first, international tariffs rise by 15 share factors throughout all industrial items. China is the largest loser on this case, seeing its GDP lower by 4.5%. The US, against this, sees a slight enhance in GDP of 0.16%, indicating “a level of resilience within the face of world commerce shifts,” the report states.

- The second state of affairs envisions a full-blown high-tech battle the place US-China commerce in items like semiconductors and superior electronics halts. China’s GDP would fall by 1.9%, the US’s would shrink by 0.9% and no nation would profit — even these deemed impartial.

- Situation three entails an entire decoupling between rival geopolitical blocs, and the financial injury can be widespread. China’s GDP would decline by 9.1% and the US would lower 4.1%. Globally, financial output would drop 4.6%, in response to the report.

Article content material

Source link