Article content material

Pickering, Ontario, Jan. 05, 2024 (GLOBE NEWSWIRE) — Ayurcann Holdings Corp. (CSE: AYUR, OTCQB: AYURF, FSE: 3ZQ0) (“Ayurcann” or the “Firm”), a number one Canadian hashish extraction firm specializing within the processing and co-manufacturing of pharma grade hashish and hemp to supply numerous by-product hashish 2.0 and three.0 merchandise within the medical and leisure market, is please to announce the next company updates.

Company Replace

Article content material

With the expansion of the hashish market and new merchandise choices into the market, Ayurcann is increasing its core inventory holding items (“SKUs”) listings within the vape, pre-roll, milled flower and focus classes, with 20 new SKUs anticipated in Ontario and Newfoundland over the subsequent 6 months. By increasing our model portfolio and model recognition, we plan to additional achieve market share to solidify our place within the Canadian leisure hashish market. Our merchandise are at present accessible in Ontario, British Columbia and Alberta.

Commercial 2

Article content material

Persevering with to construct strategic relationships and partnerships by way of fiscal 2024, Ayurcann stays dedicated and centered on exploring new alternatives in Nova Scotia and Quebec, in addition to enhancing the expansion and market share of our present listings throughout Canada. Ayurcann merchandise underneath its ‘FUEGO’, ‘XPLOR’ and ‘H&S’ manufacturers have been nicely acquired throughout the provinces with new flavours, innovation and worth contributing to their progress, publicity and gross sales. With a give attention to the quickest rising class of infused pre-roll, Ayurcann has launched 6 new SKUs for its flavour ahead vapes.

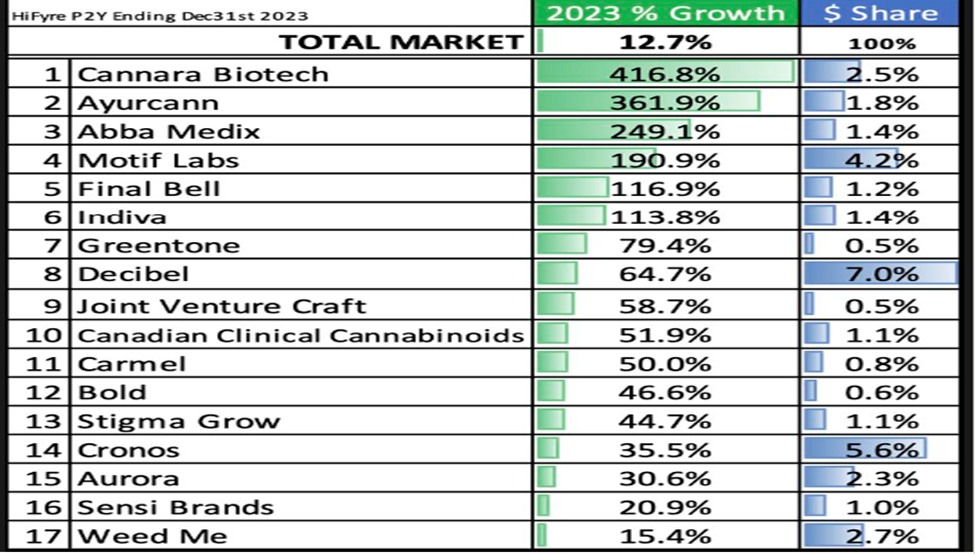

The next chart, based mostly on reporting by Hyfyre IQ™ as of December 31, 2023, denotes the Firm’s, alongside different corporations’ progress, over the previous yr (minimal of three provinces of gross sales):

Possibility and RSU Grants

The Firm can be happy to announce the grant of inventory choices (every, an “Possibility”) and restricted share items (every, an “RSU”) pursuant to the Firm’s fairness incentive plan. The Firm granted an combination of 700,000 Choices and an combination of 550,000 RSUs to sure staff and consultants of the Firm. Every Possibility is exercisable at a worth of $0.05 per Widespread Share, expires three years from the date of grant and vested instantly. Every Possibility is exercisable to buy one Widespread Share. Every RSU granted vested instantly.

Commercial 3

Article content material

The entire Choices and RSUs (and any Widespread Shares issuable upon their train and settlement) are topic to a 4 month and in the future maintain interval pursuant to the insurance policies of the CSE and relevant securities legal guidelines.

Debt Settlements

Additional to its press launch dated December 22, 2023 (the “December 22 Launch”), the Firm has accomplished debt settlements within the quantity of $756,000 with every of 2388765 Ontario Inc., an organization managed by Igal Sudman (“238 Ontario”) and 1000677847 Ontario Inc., an organization managed by Roman Buzaker (“1000 Ontario”) to protect the Firm’s money by way of the issuance of 30,240,000 Widespread Shares, at a deemed worth of $0.05 per Widespread Share (every, a “Debt Settlement”).

Capitalized phrases not in any other case outlined herein have the meanings attributed to them within the December 22 Launch.

The Widespread Shares are topic to a 4 month and in the future maintain interval pursuant to the insurance policies of the CSE and relevant securities legal guidelines. Pursuant to the insurance policies of the CSE, completion of the Debt Settlements was topic to prior approval from the disinterested Shareholders and on the Assembly the Firm acquired the requisite disinterested Shareholder approval.

Article content material

Commercial 4

Article content material

Associated Get together Transaction

Every Debt Settlement constituted a “associated social gathering transaction”, as such time period is outlined in MI 61-101 as a result of involvement of every of Messrs. Sudman and Buzaker (collectively, the “Officers”), who’re every administrators and officers of the Firm and direct and management, 238 Ontario and 1000 Ontario, respectively, and would have required the Firm to obtain minority shareholder approval for, and procure a proper valuation for the subject material of, the transaction in accordance with MI 61-101, previous to the completion of such transaction. Nevertheless, in finishing the Debt Settlements, the Firm relied on exemptions from: (x) the formal valuation necessities of MI 61-101, on the premise that the Firm shouldn’t be listed on Specified Markets (as outlined in MI 61-101), as decided in accordance with MI 61-101; and (y) the minority shareholder approval necessities of MI 61-101, on the premise that the honest market worth of every Officer’s participation of their respective Debt Settlement doesn’t exceed $2,500,000, as decided in accordance with MI 61-101.

Commercial 5

Article content material

Additional particulars might be included in a cloth change report back to be filed by the Firm. Whereas the Firm filed a cloth change report in respect of the Debt Settlements and the Officers’ participation within the Debt Settlements on January 2, 2024, the Firm didn’t file the fabric change report greater than 21 days earlier than the deadline of the Debt Settlements. Within the Firm’s view, the shorter interval was needed to allow the Firm to shut the Debt Settlements in a timeframe according to ordinary market apply for a transaction of this nature and was cheap and needed to enhance the Firm’s monetary place in a well timed method within the circumstances. Additional, the Officers indicated a want to finish the Debt Settlements on an expedited foundation.

Early Warning Disclosures

Efficient January 5, 2024, the Firm settled debt owing to 238 Ontario and 1000 Ontario within the combination quantity of $1,512,000 ( a “Transaction”). As a part of the Transactions, 238 Ontario and 1000 Ontario every transformed $756,000 of their respective debt owed by the Firm into 15,120,000 Widespread Shares, at a deemed worth of $0.05 per Widespread Share. The Widespread Shares issued in reference to every Transaction are topic to a statutory maintain interval of 4 months and a day from the date of issuance.

Commercial 6

Article content material

Previous to the closing of the Transactions, 238 Ontario, along with its joint actor, Igal Sudman, beneficially owned an combination of 29,305,424 Widespread Shares (of which 15,373,322 Widespread Shares have been owned by 238 Ontario straight and 13,932,102 Widespread Shares have been owned by Igal Sudman), representing roughly 18.06% of the whole issued and excellent Widespread Shares on a non-diluted and partially diluted foundation. 1000 Ontario, along with its joint actors, Roman Buzaker and IIPAC Inc., an organization managed by Roman Buzaker (“IIPAC”), beneficially owned an combination of 29,013,142 Widespread Shares (of which Nil Widespread Shares have been owned by 1000 Ontario straight, 15,373,322 Widespread Shares have been owned by IIPAC, and 13,639,820 Widespread Shares have been owned by Roman Buzaker), representing roughly 17.88% of the whole issued and excellent Widespread Shares on a non-diluted and partially diluted foundation.

Following the completion of the Transaction, 238 Ontario, along with its joint actor, now has possession and management over an combination of 44,425,424 Widespread Shares (of which 30,493,322 Widespread Shares are owned by 238 Ontario straight and 13,932,102 Widespread Shares are owned by Igal Sudman), representing roughly 23.08% of the whole issued and excellent Widespread Shares on a non-diluted and partially diluted foundation. 1000 Ontario, along with its joint actors, Roman Buzaker and IIPAC, now has possession and management over an combination of 44,133,142 Widespread Shares (of which 15,120,000 Widespread Shares are owned by 1000 Ontario straight, 15,373,322 Widespread Shares are owned by IIPAC, and 13,639,820 Widespread Shares are owned by Roman Buzaker), representing roughly 22.93% of the whole issued and excellent Widespread Shares on a non-diluted and partially diluted foundation.

Commercial 7

Article content material

238 Ontario, along with its joint actor, Mr. Sudman, and IIPAC, along with its joint actor, Mr. Buzaker, every most not too long ago filed an early warning report pursuant to Nationwide Instrument 62-104 – Take-Over Bids and Issuer Bids on October 18, 2022 (collectively, the “Prior EWRs”). Since then, the Firm has issued Widespread Shares in a wide range of transactions, which has resulted in every of 238 Ontario’s, along with its joint actor, Igal Sudman, and 1000 Ontario’s, along with its joint actors, IIPAC and Roman Buzaker, holdings to extend by greater than 2%. As on the date of the Prior EWRs, (i) 238 Ontario, along with its joint actor, Igal Sudman, beneficially owned an combination of 26,895,424 Widespread Shares, representing roughly 17.43% of the whole issued and excellent Widespread Shares on a non-diluted and partially diluted foundation and (ii) 1000 Ontario, along with its joint actors, Roman Buzaker and IIPAC, beneficially owned an combination of 26,603,142 Widespread, representing roughly 17.24% of the whole issued and excellent Widespread Shares on a non-diluted and partially diluted foundation.

Commercial 8

Article content material

The Widespread Shares acquired pursuant to the Transactions have been acquired by every of 238 Ontario and 1000 Ontario for funding functions, and relying on market and different situations, every of 238 Ontario and 1000 Ontario, might every now and then sooner or later enhance or lower their respective possession, management or path over securities of the Firm by way of market transactions, non-public agreements, or in any other case.

An early warning report pursuant to the necessities of relevant securities legal guidelines might be issued by every of 238 Ontario and 1000 Ontario, individually, and might be posted to SEDAR+ at www.sedarplus.ca and be accessible on request on the quantity and addresses beneath. For additional data, together with a replica of the early warning studies required underneath relevant Canadian securities legal guidelines to be filed by every of 238 Ontario and 1000 Ontario due to the Transactions, please contact Igal Sudman, Chief Government Officer, at 905-492-3322 or Roman Buzaker, Chief Monetary Officer, at 905-492-3322. For the needs of this discover, the handle of 238 Ontario and 1000 Ontario is 1080 Brock Street, Unit 6, Pickering, Ontario L1W 3H3, which can be the pinnacle workplace of the Firm.

Commercial 9

Article content material

About Ayurcann

Ayurcann is a number one post-harvest answer supplier with a give attention to offering and creating customized processes and pharma grade merchandise for the grownup use and medical hashish trade in Canada. Ayurcann is striving to turn out to be a accomplice of alternative for main Canadian hashish manufacturers by offering best-in-class, proprietary providers together with ethanol extraction, formulation, product improvement and customized manufacturing.

For extra details about Ayurcann, please go to www.ayurcann.com and its profile web page on SEDAR+ at www.sedarplus.ca.

Neither the CSE nor its Regulation Providers Supplier have reviewed or accepted duty for the adequacy or accuracy of this launch.

Cautionary Notice Relating to Ahead-Wanting Statements

This press launch comprises “forward-looking statements” throughout the which means of relevant securities legal guidelines. All statements contained herein that aren’t clearly historic in nature might represent forward-looking statements. Typically, such forward-looking data or forward-looking statements will be recognized by way of forward-looking terminology akin to “plans”, “technique”, “expects” or “doesn’t anticipate”, “intends”, “continues”, “anticipates” or “doesn’t anticipate”, or “believes”, or variations of such phrases and phrases or might comprise statements that sure actions, occasions or outcomes “might be taken”, “will launch” or “might be launching”, “will embody”, “will permit”, “might be made” “will proceed”, “will happen” or “might be achieved”. The forward-looking data and forward-looking statements contained herein embody, however are usually not restricted to, statements relating to: the Firm launching new merchandise and SKUs underneath the phrases and within the jurisdictions disclosed herein; the Firm gaining and rising its market share; the Firm constructing extra strategic relationships and partnerships; the Firm’s changing into the accomplice of alternative for main Canadian and worldwide hashish manufacturers; and the Firm’s plans to supply numerous by-product hashish merchandise.

Commercial 10

Article content material

Ahead-looking data on this information launch are based mostly on sure assumptions and anticipated future occasions, specifically: the Firm has the power to supply numerous by-product hashish merchandise; the Firm will launch new merchandise and SKUs underneath the phrases and within the jurisdictions disclosed herein; the Firm will achieve and develop its market share; the Firm will construct extra strategic relationships and partnerships; the Firm’s evaluation of market situations, its capability to realize market share, and its potential aggressive edge are correct; the Firm has the power to hold out its plans with respect to its new innovation and choices; the Firm has the power to boost its product improvement capabilities; the Firm will search new Canadian enterprise alternatives; the Firm will enhance effectivity in its processes and partnerships; and the Firm has the power to hold out its objectives and aims.

These statements contain recognized and unknown dangers, uncertainties and different elements, which can trigger precise outcomes, efficiency or achievements to vary materially from these expressed or implied by such statements, together with however not restricted to: the Firm might be unable to launch new merchandise and SKUs underneath the phrases, within the jurisdictions disclosed herein and/or in any respect; the Firm being unable to realize and/ow develop its market share; the Firm’s incapability to construct extra strategic relationships and/or partnerships; the Firm’s incapability to turn out to be the accomplice of alternative for main Canadian and worldwide hashish manufacturers; the Firm’s incapability to supply numerous by-product hashish merchandise; the Firm’s incapability to hold out its plans with respect to its new innovation and choices; and the Firm’s incapability to boost its product improvement capabilities.

Commercial 11

Article content material

Readers are cautioned that the foregoing checklist shouldn’t be exhaustive. Readers are additional cautioned to not place undue reliance on forward-looking statements, as there will be no assurance that the plans, intentions, or expectations upon which they’re positioned will happen. Such data, though thought-about cheap by administration on the time of preparation, might show to be incorrect and precise outcomes might differ materially from these anticipated.

Ahead-looking statements contained on this information launch are expressly certified by this cautionary assertion and replicate the Firm’s expectations as of the date hereof and are topic to alter thereafter. The Firm undertakes no obligation to replace or revise any forward-looking statements, whether or not because of new data, estimates or opinions, future occasions, or outcomes or in any other case or to elucidate any materials distinction between subsequent precise occasions and such forward-looking data, besides as required by relevant regulation.

This press launch shall not represent a suggestion to promote or the solicitation of a suggestion to purchase nor shall there be any sale of the securities in any state wherein such provide, solicitation or sale can be illegal. The securities being supplied haven’t been, nor will they be, registered underneath the USA Securities Act of 1933, as amended, and is probably not supplied or bought in the USA absent registration or an relevant exemption from the registration necessities of the USA Securities Act of 1933, as amended, and relevant state securities legal guidelines.

Article content material

Source link