Asian equities can stay up for a lift from rate of interest cuts and a weaker greenback in 2024, nevertheless it’s China that may decide the area’s efficiency versus friends.

Article content material

(Bloomberg) — Asian equities can stay up for a lift from rate of interest cuts and a weaker greenback in 2024, nevertheless it’s China that may decide the area’s efficiency versus friends.

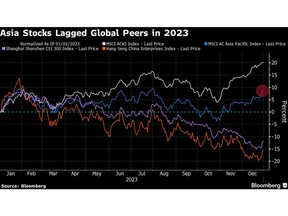

Whether or not the world’s second-biggest economic system can lastly recuperate and repair its embattled property sector is among the many major questions for buyers this 12 months. Chinese language shares ended 2023 with a report third 12 months of losses and contributed to the MSCI Asia Pacific Index trailing world equities by 11 share factors.

Commercial 2

Article content material

Article content material

India, South Korea and Taiwan will see their double-digit rallies examined by election outcomes. In Japan, a possible pivot by the central financial institution will decide how exporters’ shares fare after the inventory gauges had their greatest 12 months since 2013.

Beneath are the 5 areas of focus for Asia fairness buyers in 2024:

China Restoration

After one other dismal 12 months for China bulls, buyers will watch conferences of the Nationwide Folks’s Congress and the third plenum for Beijing’s development goal for 2024 and clues on fiscal stimulus.

China’s outlook stays challenged however Beijing has did not unleash a wider-ranging stimulus as hoped by the market. Merchants are pinning hopes on the Folks’s Financial institution of China to enact extra coverage easing, though any market impression has thus far been short-lived.

Sudden draft laws on the gaming trade in December have reignited worries about Beijing’s stance on personal enterprise, whereas the semiconductor and clear power sectors should be caught within the crossfire if geopolitical tensions with the West flare up.

Coverage Pivots

Dovish Federal Reserve narrative and the well being of the US economic system shall be essential to the route of the greenback and rates of interest in Asia, and can drive demand for the area’s shares.

Article content material

Commercial 3

Article content material

Buyers may also search for a sign from Financial institution of Japan Governor Kazuo Ueda to lastly exit unfavourable charges. His feedback final month counsel the central financial institution might transfer as early as April. Larger borrowing prices might enhance the yen and harm index-dominating exporter shares, scuppering the continued rally in Japanese shares.

Learn extra: Korea, India Shares Poised for Greatest International Inflows in Years

Election Calendar

A busy lineup of polls in key markets together with India, Indonesia, South Korea and Taiwan within the first half will see buyers flip focus to political danger.

Taiwan’s election this month is anticipated to form US-China ties, whereas in India and Indonesia, buyers are betting pro-growth insurance policies of Prime Minister Narendra Modi and President Joko Widodo will proceed.

The impression of South Korea’s April legislative election is already being felt with a ban on brief promoting aimed toward defending retail buyers. President Yoon Suk Yeol has pledged to scrap the deliberate capital features tax on earnings from monetary investments and promised reforms together with modifications to the pension system and the prevention of market monopolies.

Commercial 4

Article content material

Learn extra: Asia Shares in Higher Form Than US to Climate Election Turmoil

India Momentum

The nation stays a shiny spot even with benchmark fairness gauges at report ranges after an eight-year profitable run.

International buyers are bullish as India baggage high-profile manufacturing contracts, boosts infrastructure spend and emerges as a substitute for China.

Modi’s get together is extensively anticipated to win the election anticipated in April or Could, particularly after his victories within the just lately concluded state polls. Buyers face the danger of a big market correction — of 25% or extra based on Jefferies LLC — if the ruling administration suffers a shock defeat.

Chip Issues

ChatGPT’s success drove an surprising increase in chip shares in 2023. The onus is now on Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. — the world’s two main contract chipmakers — to indicate how synthetic intelligence-linked demand is boosting earnings.

Larger demand from the US and China may also be key to maintain the optimism round these exporters after Korea’s chip manufacturing and shipments recorded the most important features in years in November — an indication of an upturn within the semiconductor cycle.

Article content material

Source link