Japan’s inflation continued to outpace expectations, including to intense scrutiny over subsequent week’s Financial institution of Japan coverage assembly — the primary beneath its new chief Kazuo Ueda.

![u7ypg26{kjle17}f]x1kk[k]_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/04/still-heating-up-japans-inflation-trend-stronger-after-excl.jpg?quality=90&strip=all&w=288&h=216&sig=TIq3P-QGme6ejHzs_0aOMQ)

Article content material

(Bloomberg) — Japan’s inflation continued to outpace expectations, including to intense scrutiny over subsequent week’s Financial institution of Japan coverage assembly — the primary beneath its new chief Kazuo Ueda.

Commercial 2

Article content material

Client costs excluding contemporary meals rose 3.1% in March from a 12 months in the past, matching the tempo of the earlier month, the interior affairs ministry mentioned Friday. Economists had anticipated the inflation measure to ease to three%.

Article content material

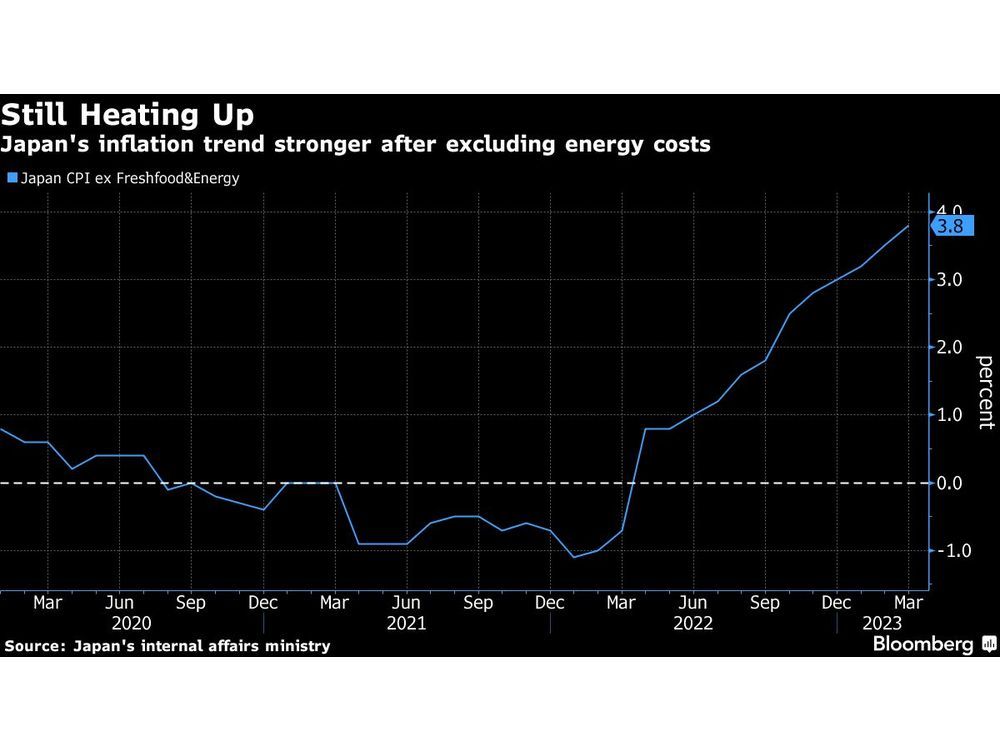

A separate gauge of worth progress that excludes each power and contemporary meals additionally proved stronger than anticipated, climbing to three.8% for its highest studying since 1981. The determine, thought of an indicator of underlying worth tendencies, appeared to indicate surprising stickiness, even when the margins look comparatively small as compared with different main economies.

Forecasting inflation to fall under 2% later this 12 months, the BOJ has mentioned its ultra-easy financial coverage remains to be applicable as its inflation goal hasn’t been achieved in a sustainable method. That’s a line Ueda has largely adopted since taking the helm of the central financial institution earlier this month.

Article content material

Commercial 3

Article content material

Nonetheless, with inflation above the BOJ’s 2% goal for a twelfth straight month, hypothesis continues to simmer that the central financial institution will pull again from its stimulus program within the coming months. The change in management has added to market discuss of a doable shift.

“Underlying inflation is robust as proven by the determine excluding contemporary meals and power,” mentioned Koya Miyamae, senior economist at SMBC Nikko Securities. “Japanese firms are passing their prices in phases so the impression of final 12 months’s dramatic improve in import costs is continuous.”

Processed meals was the most important driver of costs, gaining 8.2% for the most important improve since 1976. Greater than 20,000 meals objects together with seaweed and noodles are set to go up in worth by way of July this 12 months, reaching that mark at a a lot sooner tempo than final 12 months, in response to a Teikoku Databank report.

Commercial 4

Article content material

“Stress to boost meals costs remains to be persevering with, and meals costs will stay excessive for a couple of half 12 months,” mentioned Takeshi Minami, chief economist at Norinchukin Analysis Institute. “Additionally, wages have been growing just lately. That may be seen as a chance to boost costs.”

Prime Minister Fumio Kishida’s administration has applied a collection of measures to maintain a lid on costs, regardless of its long-running goal to realize inflation, to curb voter dissatisfaction and to make sure inflation doesn’t upend shopper spending.

The stop-gap strikes have been masking the power of the inflation pattern, making it sophisticated for policymakers to evaluate its momentum. The most recent launch confirmed that total worth progress would have been round 4.3% with out the downward strain of presidency subsidies for pure gasoline, electrical energy and home journey.

Commercial 5

Article content material

What Bloomberg Economics Says…

“For the Financial institution of Japan, the message is prone to be that inflation remains to be largely powered by larger prices, not pulled by stronger demand. We doubt Friday’s information will change the calculus for the BOJ — we nonetheless see it standing pat at subsequent week’s assembly.”

— Chang Shu, economist

For the complete report, click on right here

Nonetheless, economists largely subscribe to the view that worth progress will cool because the 12 months progresses even when they differ over the tempo of deceleration. The consensus view can be that Ueda will maintain off on altering coverage for now.

BOJ officers are cautious of tweaking or scrapping their management of yields on the assembly so quickly after the banking disaster abroad clouded the outlook, in response to folks acquainted with the matter.

Commercial 6

Article content material

A Bloomberg survey of 47 economists, confirmed that 87% of respondents count on no change on the upcoming assembly. Lots of them cited the monetary sector turmoil as an element.

Nonetheless, the identical ballot confirmed that greater than half of respondents count on that when the BOJ chooses to scrap yield curve management, it is going to achieve this with out warning.

“Right now’s information might have impression on BOJ’s inflation outlook,” Miyamae mentioned. “Nonetheless on whether or not they’re going to elevate charges anytime quickly, I doubt it, as a result of their view is that inflation will weaken from its present power.”

—With help from Jon Herskovitz.

(Provides economist feedback)

Source link

Feedback

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We’ve got enabled e mail notifications—you’ll now obtain an e mail should you obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Community Guidelines for extra info and particulars on tips on how to regulate your email settings.

Be a part of the Dialog