Warren Buffett is popping his focus again to Japan, with the billionaire investor telling Nikkei that he’s mulling a lift to his inventory investments within the nation shortly after Berkshire Hathaway Inc. kicked off a yen bond sale.

![925]jbb6fwr4wj1s014woy}6_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/04/yen-corporate-bonds-spreads-surge-on-boj-policy-speculation.jpg?quality=90&strip=all&w=288&h=216&sig=E-RCnyxxDhA5YV32w2KC2Q)

Article content material

(Bloomberg) — Warren Buffett is popping his focus again to Japan, with the billionaire investor telling Nikkei that he’s mulling a lift to his inventory investments within the nation shortly after Berkshire Hathaway Inc. kicked off a yen bond sale.

Commercial 2

Article content material

Shares of Japan’s main buying and selling homes jumped after Buffett mentioned he has raised his holdings in them to 7.4% from about 5% in 2020 and is seeking to enhance his publicity to the nation’s shares, based on the Nikkei report.

Article content material

The 92-year-old Buffett is at the moment in Japan and plans to fulfill with totally different firm leaders and “simply have a dialogue round their companies and emphasize our help,” he instructed Nikkei, with out naming the businesses.

Within the interview, Buffett in contrast Japan’s 5 giant buying and selling homes to Berkshire and mentioned he would do enterprise with them.

“We’d love if any of the 5 would come to us ever and say, ‘We’re pondering of doing one thing very massive or we’re about to purchase one thing and we want a accomplice or no matter,’” he mentioned, based on Nikkei.

Article content material

Commercial 3

Article content material

He then added that whereas he doesn’t have a stake in different main Japanese corporations, “there are at all times a number of I’m enthusiastic about,” Nikkei reported.

Buffett’s curiosity is “a reminder that there are enticing and well-priced funding alternatives in Japan,” mentioned Lorraine Tan, director of fairness analysis at Morningstar Asia. “Given what we all know to be his preferences, he could be on the lookout for well-managed corporations that get pleasure from financial moats which he thinks are undervalued.”

Officers on the firm didn’t instantly reply to a request for touch upon the Nikkei story.

Japan’s buying and selling homes — or “sogo shosha” — have deep roots within the nation’s financial system, relationship again a whole bunch of years and offering every part from power to meals.

Commercial 4

Article content material

Worth Shares

Shares of Mitsubishi Corp., the most important buying and selling home, jumped as a lot as 3%, probably the most since March 1. Mitsui & Co. surged as a lot as 3.7%, whereas Marubeni Corp., Sumitomo Corp. and Itochu Corp. additionally edged increased. Japan’s Topix prolonged beneficial properties after information of the report.

Buffett’s remarks “could encourage overseas traders to put money into Japanese shares, particularly in worth shares,” Hiroshi Namioka, chief strategist at T&D Asset Administration.

Foreigners have web offered Japanese shares and futures from the Tokyo Inventory Trade for the final three weeks following the worldwide banking disaster in March, although they continue to be web consumers to date this 12 months. Over the previous 12 months, the MSCI Asia Pacific excluding Japan Index has dropped 8.6%, in contrast with a 0.8% decline within the broader Topix utilizing greenback phrases.

Commercial 5

Article content material

It’s not clear how lengthy the market increase from his remarks to Nikkei will final.

“Buffett’s investments a number of years in the past didn’t ignite the market a lot within the quick time period, apart from for the shares he selected or these very like them, however I consider that it had a reasonably constructive impact within the intermediate to long run concerning overseas perceptions of Japan’s market,” mentioned John Vail, chief international strategist at Nikko Asset Administration Co. including that this may additionally help home optimism.

Buying and selling homes in Japan have already gained over the previous 12 months as corporations similar to Mitsui and Mitsubishi expanded buyback program plans in February. Firm earnings have additionally been boosted by the upper power costs. Shares of Japan’s largest buying and selling firm Mitsubishi are up 14% up to now 12 months, in comparison with the broader Topix index which is up 5.4%.

Commercial 6

Article content material

Individually, Berkshire’s US holding firm is about to cost its new bonds as quickly as this week, in what could be the primary yen issuance from an abroad issuer since Kazuo Ueda took the helm on the Financial institution of Japan this month. The proceeds from the providing shall be used for normal company functions, together with refinancing some debt.

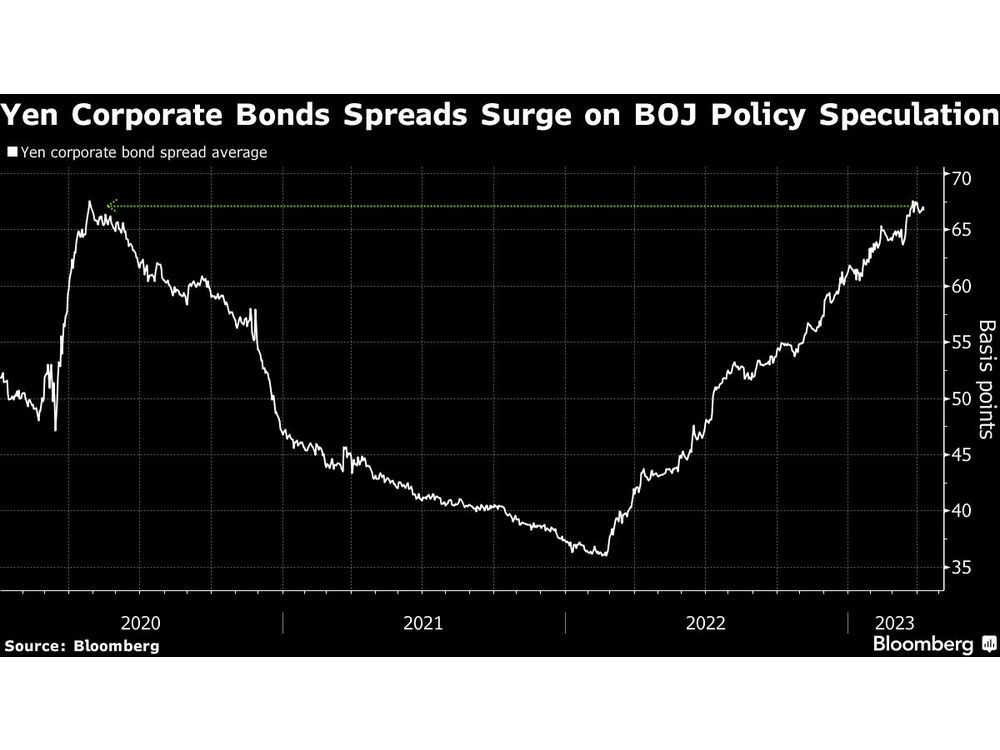

The legendary investor’s firm is providing wider credit score spreads on tranches within the new deal than when it final tapped the market in December, as hypothesis in regards to the BOJ pulling again on ultra-easy coverage drove yield premiums increased this 12 months. Nonetheless, Ueda signaled at his inaugural information convention Monday that any vital coverage modifications could also be unlikely in the interim.

Berkshire has already began advertising and marketing a seven-tranche bond sale, based on an individual acquainted with the matter.

Omaha, Nebraska-based Berkshire is likely one of the largest overseas issuers of yen bonds, information compiled by Bloomberg present. The agency stunned Japanese markets in 2020 when it purchased shares in native buying and selling corporations after promoting one of many biggest-ever yen bond offers by an abroad firm.

—With help from Winnie Hsu, Yasutaka Tamura, Katherine Chiglinsky and Hideyuki Sano.

Source link

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We’ve got enabled e mail notifications—you’ll now obtain an e mail when you obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a person you comply with feedback. Go to our Community Guidelines for extra data and particulars on alter your email settings.

Be a part of the Dialog