OPEC+ remains to be discovering that the most effective response to rising oil market uncertainty is to carry its floor.

Article content

(Bloomberg) — OPEC+ is still finding that the best response to growing oil market uncertainty is to hold its ground.

Advertisement 2

Article content material

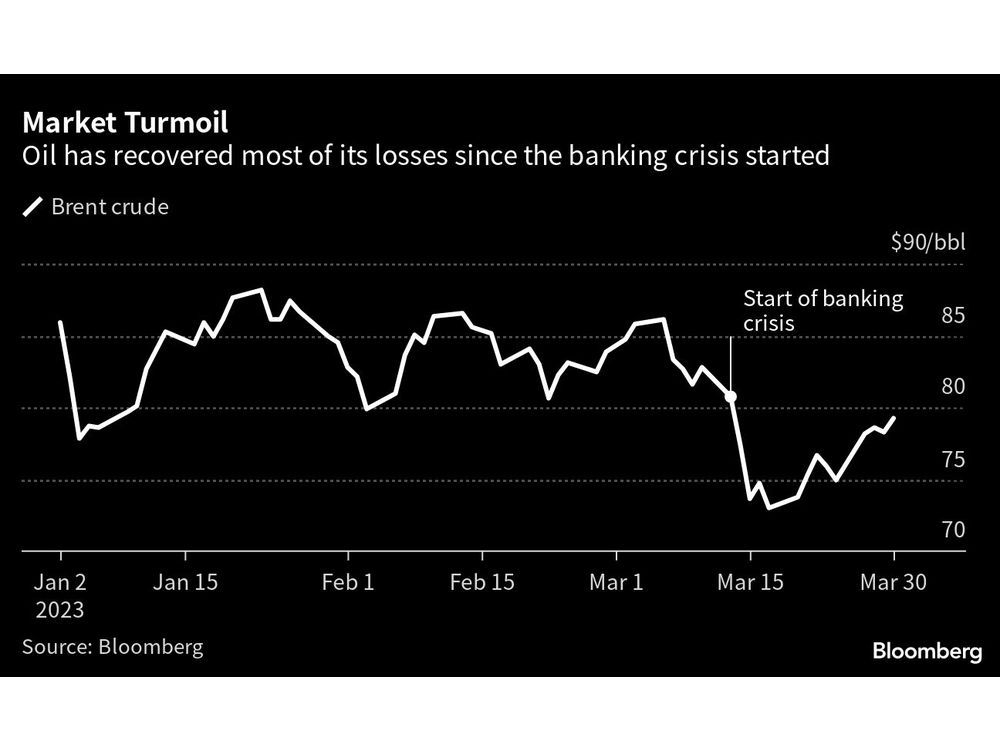

When final month’s banking disaster dragged crude futures to a 15-month low close to $70 a barrel in London, hypothesis swirled that Saudi Arabia and its companions may intervene with contemporary manufacturing cuts to shore up the market.

Article content material

However regardless of all of the upheaval, OPEC+ reveals each signal of sitting tight. The Saudis have mentioned publicly that the 23-nation coalition ought to preserve output ranges regular all 12 months. Delegates privately predict that, when key members maintain a monitoring assembly on Monday, they gained’t make any changes.

Fears over monetary contagion are receding and the main focus is returning as soon as once more to China’s resurgent oil demand, coupled with stress on Russian output since its invasion of Ukraine. Crude futures have recovered sharply to nearly $80 a barrel, buttressing income for Riyadh and its allies.

Article content material

Commercial 3

Article content material

“OPEC can intervene with markets when it feels there’s an oversupply,” mentioned Marco Dunand, chief govt officer of commodities dealer Mercuria Vitality Group Ltd. However “it’s extra possible that when we undergo this, we’re going to see the market coming again up.”

The oil-market outlook confronting the Group of Petroleum Exporting Nations and its companions stays cloudy.

Confidence that costs have been heading again to $100 a barrel, widespread within the petroleum trade at first of the 12 months, has frayed as Russian exports show resilient in opposition to worldwide sanctions. It appears to be like like international provide will probably be in surplus this quarter.

China’s modest new financial development goal of 5% has additionally sapped optimism amongst oil traders. Even Goldman Sachs Group Inc., maybe essentially the most enthusiastic crude bull on Wall Road, has dropped predictions of a return to triple digits this 12 months.

Commercial 4

Article content material

The reverberations from the collapse of Silicon Valley Financial institution and unraveling of Credit score Suisse Group AG additional darkened crude’s prospects.

Take a look at of Resolve

There was hypothesis that the value rout may check the resolve of Saudi Vitality Minister Prince Abdulaziz bin Salman, who mentioned final month that the manufacturing targets fastened when OPEC+ slashed output in late 2022 are “right here to remain for the remainder of the 12 months, interval.”

These predictions have diminished amid crude’s subsequent restoration.

“The OPEC management will very possible resolve that there isn’t a have to train the extra reduce possibility” subsequent week, mentioned Helima Croft, head of commodity technique at RBC Capital Markets LLC. “However we don’t see the group remaining on autopilot till year-end if oil descends into one other tailspin.”

Commercial 5

Article content material

High oil merchants like Trafigura Group Pte Ltd. and Gunvor Group don’t anticipate an additional worth droop. In reality, they predict a rally within the second half of 2023 as China absolutely emerges from years of Covid lockdowns. Goldman Sachs, whereas softening its preliminary worth expectations, has doubled down on requires a commodities increase.

International oil demand stays on observe to extend by 2 million barrels a day this 12 months to a report 102 million a day, shifting the market right into a deficit this summer time, in response to the Worldwide Vitality Company in Paris.

The sturdy outlook for oil consumption comes alongside a pinch on international provides.

Russia, a member of the OPEC+ alliance, has introduced a manufacturing cutback of 500,000 barrels a day this month in retaliation for sanctions, and promised to maintain the discount in place by to June. European nations have banned Russian barrels, and solely present facilitating providers to nations that buy shipments for lower than $60 a barrel.

Commercial 6

Article content material

Whereas the nation’s oil trade has to this point defied predictions of a collapse by diverting crude flows Asia, there are indicators that the commerce is slowing down, with gasoline cargoes floating idle off the coast of Europe, Africa and Latin America.

Additional disruption is being felt in OPEC member Iraq. A renewed authorized dispute between Baghdad and the nation’s northern Kurdish area is locking in about 400,000 barrels a day that may usually movement by through Turkey to worldwide markets.

When OPEC+ meets in early June to evaluation output ranges for the second half, it could have a possibility to open the faucets. Within the meantime, ministers are more likely to preserve a wait-and-see method, in response to Bob McNally, president of Rapidan Vitality Group and a former White Home official.

“I think they’ll be preserving their heads down and eyes open,” McNally mentioned.

—With help from Salma El Wardany, Ben Bartenstein and Fiona MacDonald.

Source link

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We have now enabled e mail notifications—you’ll now obtain an e mail if you happen to obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Community Guidelines for extra data and particulars on the best way to regulate your email settings.

Be a part of the Dialog