The Federal Reserve’s most popular measure of underlying worth pressures most likely remained elevated in February, protecting officers in a precarious spot as they search to stability inflation-fighting resolve and stress on the banking system.

Article content material

(Bloomberg) — The Federal Reserve’s most popular measure of underlying worth pressures most likely remained elevated in February, protecting officers in a precarious spot as they search to stability inflation-fighting resolve and stress on the banking system.

Commercial 2

Article content material

The US private consumption expenditures worth index, excluding meals and gas, is forecast to rise 0.4% from a month earlier, in keeping with the Bloomberg survey median. That may observe the most important advance since June.

Article content material

In contrast with February 2022, the core inflation gauge is seen up 4.7%, whereas the general measure is projected to put up a 5.1% advance — each greater than double the Fed’s purpose.

Coverage makers on Wednesday raised their benchmark rate of interest for the ninth straight assembly, to the best since 2007, whereas stressing that their bid to tamp down inflation isn’t anticipated to deepen a nascent banking disaster. Nonetheless, rising borrowing prices threat including to pressures on the monetary system that would tip the financial system right into a recession.

Commercial 3

Article content material

The federal government’s information on Friday are additionally anticipated to point out inflation-adjusted private spending declined in February after surging a month earlier.

What Bloomberg Economics Says:

“Fed Chair Jerome Powell’s most popular ‘supercore’ inflation indicator – core PCE companies excluding housing – seemingly will present the sticky part of inflation operating steadily at 4%-5% over the previous few months, not an encouraging signal of progress on disinflation.”

—Anna Wong, Stuart Paul, Eliza Winger and Jonathan Church, economists. For full evaluation, click on right here

The earnings and spending report takes prime billing in a subdued week for US financial releases that features readings on shopper confidence, house costs, and contract signings for purchases of previously-owned homes.

Article content material

Commercial 4

Article content material

Traders will seemingly pay nearer consideration to Fed officers this coming week in hopes of gauging the urge for food for additional price hikes. Fed Governor Philip Jefferson will talk about financial coverage at occasion on Monday, adopted later within the week by speeches from Boston Fed President Susan Collins, Richmond Fed President Tom Barkin, and governors Christopher Waller and Lisa Cook dinner.

Fed Vice Chair for Supervision Michael Barr is scheduled to testify at separate hearings of the Senate Banking Committee and the Home Monetary Companies Committee on latest financial institution failures.

Additionally in North America, Canadian Finance Minister Chrystia Freeland unveils a federal funds, promising prudence even because the Trudeau authorities faces strain to ramp up spending on clean-technology incentives to remain aggressive with the Biden administration’s beneficiant new industrial coverage within the US.

Commercial 5

Article content material

And elsewhere, euro-zone inflation information are anticipated to disclose conflicting indicators on worth development, China’s buying supervisor indexes will present the energy of manufacturing facility exercise there, and central-bank choices could characteristic price hikes from South Africa to Mexico.

Click on right here for what occurred final week and under is our wrap of what’s arising within the world financial system.

Asia

The energy of China’s buying supervisor indexes shall be a key focus for buyers and coverage makers attempting to take the heartbeat of the restoration on the earth’s second-largest financial system within the aftermath of lifted pandemic restrictions.

The PMIs come amid a slew of regional information on Friday, together with industrial output from South Korea and employment manufacturing facility output and Tokyo inflation figures from Japan for March, which observe promising nationwide information for the prior month.

Commercial 6

Article content material

Value development numbers Down Underneath due out the day past will assist form views on the Reserve Financial institution of Australia’s subsequent price determination in early April.

The Financial institution of Thailand, in the meantime, is anticipated to lift borrowing prices once more on Thursday.

- For extra, learn Bloomberg Economics’ full Week Forward for Asia

Europe, Center East, Africa

The information spotlight within the euro zone shall be inflation on Friday, a report seemingly to offer ammunition to each hawks and doves on the European Central Financial institution in regards to the subsequent price transfer.

On the one hand, headline worth development is more likely to fall drastically — with all however one economist predicting a drop, and essentially the most optimistic forecasts exhibiting declines of virtually two proportion factors. That dynamic could mirror related inflation slowdowns in every of the area’s greatest economies.

Commercial 7

Article content material

However an underlying euro-zone gauge that strips out risky parts resembling power and meals may go the opposite method, accelerating additional to achieve a brand new euro-era report.

Inflation prospects at a time of renewed financial institution turmoil could preoccupy ECB officers in a number of appearances. Speeches by Bundesbank chief Joachim Nagel on Monday and Tuesday may draw consideration amid investor hypothesis swirling round Deutsche Financial institution AG.

ECB President Christine Lagarde will make remarks on Tuesday in Frankfurt, after which will seem in Florence on Friday.

Within the UK, Financial institution of England Governor Andrew Bailey delivers a speech on the London College of Economics on Monday, and can testify the subsequent day on the UK rescue of the native arm of California’s Silicon Valley Financial institution.

Commercial 8

Article content material

And Swiss Nationwide Financial institution official Andrea Maechler, whose establishment simply raised charges after overseeing the compelled takeover of Credit score Suisse Group AG, speaks in Zurich on Thursday.

Elsewhere within the area, Turkey’s commerce deficit is anticipated to have widened additional in February, with information due Friday exhibiting the affect of hovering power payments.

And in Russia, shopper and industrial manufacturing information on Wednesday will give a recent studying on whether or not the gradual restoration after a 12 months of battle is constant.

A number of price choices are due. Right here’s a fast abstract for Japanese Europe:

- In Hungary on Tuesday, officers could subject new steerage, with all eyes on after they may begin chopping the European Union’s highest benchmark borrowing prices.

- The Czech central financial institution on Wednesday is more likely to preserve its personal price unchanged on the highest degree since 1999.

Commercial 9

Article content material

And right here’s a have a look at what central banks across the African continent could do:

- On Monday, the Financial institution of Ghana is anticipated to face pat after lifting its price by 14.5 proportion factors since November 2021.

- Kenyan coverage makers on Wednesday will seemingly enhance borrowing prices to struggle excessive inflation and protect the native foreign money from weak point towards the greenback.

- Additionally on Wednesday, Mozambique could keep on maintain, even with one of many highest actual charges in Africa, seeing double-digit inflation anticipated to endure for months.

- In Egypt on Thursday, officers could ship a jumbo price enhance after a critical of foreign money devaluations despatched meals costs to a report excessive.

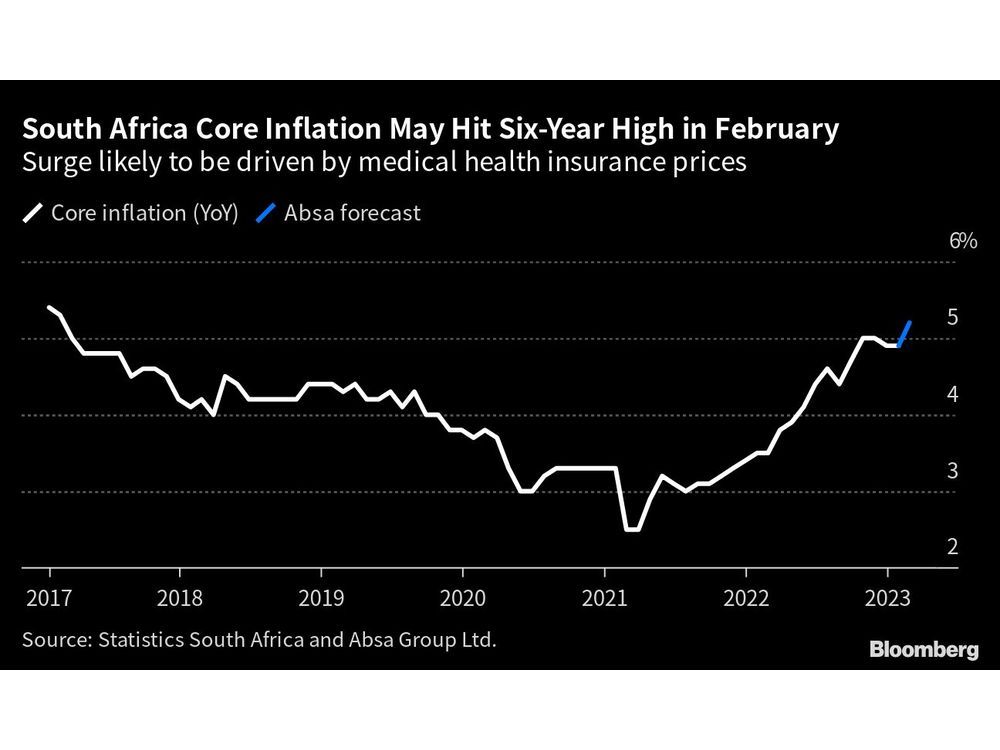

- And the identical day. the South African Reserve Financial institution will most likely increase charges by 25 foundation factors to deal with inflation dangers, together with the affect of a weaker foreign money.

Commercial 10

Article content material

- For extra, learn Bloomberg Economics’ full Week Forward for EMEA

Latin America

Amid a busy week in Brazil — the weekly Focus survey of analysts, present account, lending, the broad IGP-M inflation report — the assembly minutes of the central financial institution’s March 22 price determination and the quarterly inflation report stand out.

Brazil watchers on Tuesday shall be eager to see if the post-decision’s hawkish language carries over to the assembly minutes. Two days later, the report itself could take a again seat to the post-release presser given by central financial institution chief Roberto Campos Neto, who’s squarely in President Luiz Inacio Lula da Silva’s crosshairs over Brazil’s 13.75% key price.

In Argentina, January GDP-proxy information could present a fifth straight adverse print as drought, triple-digit inflation and tight foreign money circumstances undercut exercise.

Commercial 11

Article content material

Chile within the coming week posts six indicators for February, all more likely to underscore the lack of momentum that’s broadly anticipated to tip the financial system into recession this 12 months.

Rounding out the week, the central banks of Mexico and Colombia are all however sure to increase report mountain climbing campaigns with quarter-point will increase, although each are nearing their respective terminal charges.

Search for Banxico to lift its key price for a fifteenth straight time to 11.25%, whereas Banco de la República de Colombia hikes for a thirteenth straight assembly to 13%.

- For extra, learn Bloomberg Economics’ full Week Forward for Latin America

—With help from Robert Jameson, Malcolm Scott, Michael Winfrey, Stephen Wicary and Gregory L. White.

Source link

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. Now we have enabled e-mail notifications—you’ll now obtain an e-mail when you obtain a reply to your remark, there may be an replace to a remark thread you observe or if a consumer you observe feedback. Go to our Community Guidelines for extra info and particulars on find out how to alter your email settings.

Be part of the Dialog