Every week of banking turmoil is sparking a rout throughout the systematic-investing world akin to the Covid-era disruption, hammering quants who had been simply discovering their ft after a difficult begin to the yr.

Article content

(Bloomberg) — A week of banking turmoil is sparking a rout across the systematic-investing world akin to the Covid-era disruption, hammering quants who were just finding their feet after a challenging start to the year.

Advertisement 2

Article content material

Bother at Credit score Suisse Group AG — on the heels of regional banking dysfunction within the US — is hitting common rules-based trades as traders wager the disaster foreshadows an finish to Federal Reserve coverage tightening.

Article content material

Whereas the direct hyperlink between charges and quant methods is far debated, prior to now few periods bonds have surged, low-cost shares struggled and megacaps have been resurgent — market circumstances that go immediately towards what number of programmatic trades are presently arrange.

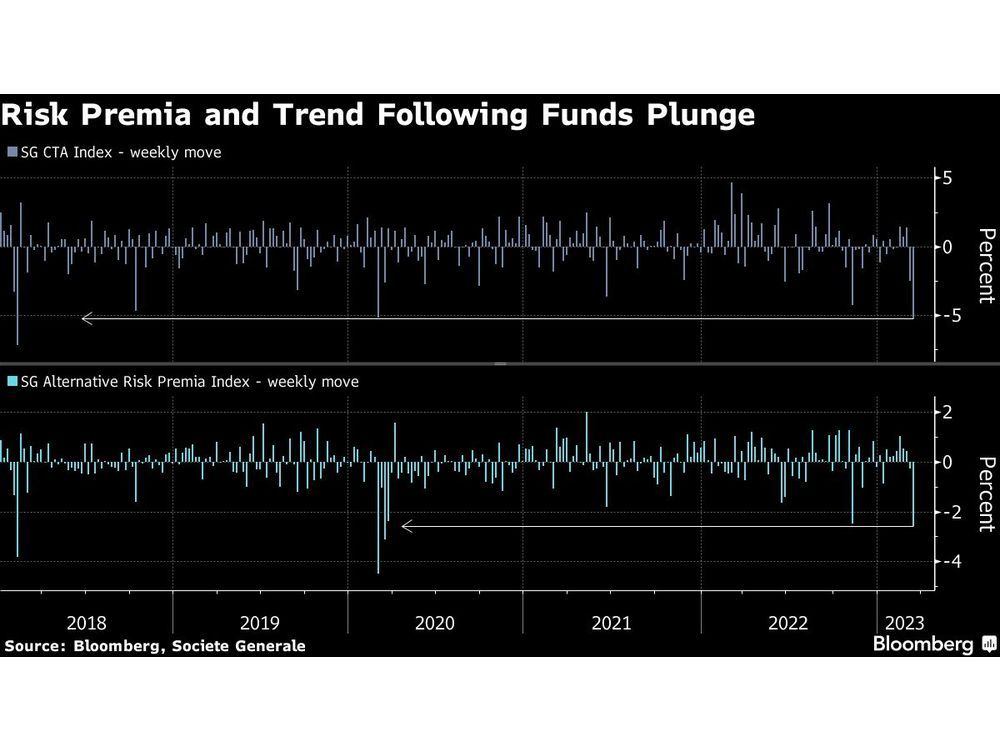

Final week was the worst since spring 2020 for a Bloomberg index monitoring the worth technique, which bids up shares which are low-cost by some measure. It was the identical for a Societe Generale SA gauge of other danger premia, which tracks issue investing throughout asset lessons.

Article content material

Commercial 3

Article content material

Pattern-following quants that commerce futures throughout belongings, often called commodity buying and selling advisors, had it even worse, posting the steepest drop since 2018.

“There are some fairly nasty numbers from the final couple of days,” mentioned Michael Harris, president of Quest Companions LLC, a $2.7 billion CTA that rides short-term traits. “One of many large positions that has solely begun to get unwound in our area is the big focus of shorts in world fastened revenue.”

Harris reckons that has additional to go if bonds proceed to rally. Quest has turned impartial in fastened revenue, gone lengthy on gold and brief on world shares and vitality, he mentioned.

Total, the cohort is prone to catch a break Monday as danger urge for food recovered and methods like worth jumped.

Commercial 4

Article content material

But the tumult is already elevating large questions for Wall Avenue’s math-driven cohort, who famously struggled by way of the period of low charges and a one-way bull market powered by Large Tech shares. Quants had been resurgent within the final two years as rampant inflation created new currents throughout markets and the dominance of some megacaps started to ebb.

After a painful begin to the brand new yr, given the sudden increase in market bets that the Fed was accomplished with its mountaineering regime, systematic merchants had been again to their successful methods of late.

Now the demise of Credit score Suisse so shortly after Silicon Valley Financial institution and two different US lenders collapsed is fueling doubts over the resilience of the worldwide financial system. Many traders sense a flip within the financial cycle.

Commercial 5

Article content material

In shares, the latest flight to security favored Large Tech names like Alphabet Inc. and Microsoft Corp. — a cohort that quants are much less uncovered to virtually by definition, since they like diversified portfolios. An equal-weighted model of the S&P 500 posted its worst week versus the capitalization-weighted index since March 2020, that means that the most important shares typically did higher.

In the meantime, traders have been ditching danger. A Bloomberg index that targets the leverage issue throughout US shares — or corporations which are extremely indebted — slid essentially the most since April 2020 final week.

Even funds deploying a number of various factors throughout equities struggled. The AQR Fairness Market Impartial Fund and Jupiter Merian International Fairness Absolute Return Fund each posted their worst weeks since June, information compiled by Bloomberg present.

For Christopher Harvey and his workforce at Wells Fargo, even when the Fed slows tightening, it’s time to rotate into much less cyclical shares with longer durations.

“If the Fed indicators a cloth pause this week, it might be a near-term plus for danger markets,” the analysts wrote in a Monday notice. “The anticipated capital points and the conduct impression from the banking stress will doubtless spill over to the financial system.”

Source link

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. Now we have enabled e mail notifications—you’ll now obtain an e mail if you happen to obtain a reply to your remark, there may be an replace to a remark thread you comply with or if a consumer you comply with feedback. Go to our Community Guidelines for extra info and particulars on find out how to modify your email settings.

Be a part of the Dialog