Article content material

(Bloomberg) — A Morgan Stanley unit was fined £5.4 million ($6.9 million) for failure to retain messages despatched by merchants over WhatsApp within the first-ever penalty of its kind issued underneath the UK vitality regulator’s powers.

Morgan Stanley & Co. Worldwide Plc didn’t document and retain digital communications between January 2018 and March 2020 made by vitality merchants on privately-owned telephones which mentioned transactions, Ofgem mentioned in a press release on Wednesday.

Article content material

Morgan Stanley has taken steps to make sure the breaches don’t occur once more, in keeping with Ofgem, which regulates UK vitality markets. Hugh Fraser, a spokesperson for the financial institution, declined to remark.

The high-quality is the primary issued by Ofgem underneath authorized necessities to document and retain communications referring to wholesale vitality buying and selling. It additionally follows a slew of actions by US regulators to clamp down on the usage of WhatsApp in buying and selling flooring the world over.

Ofgem discovered that Morgan Stanley’s personal guidelines prohibited utilizing the messaging app for buying and selling issues, however didn’t “take adequate affordable steps to make sure compliance with its personal insurance policies,” in keeping with the assertion. The financial institution’s settlement within the case led to 30% low cost in its high-quality, which is able to go to the UK Treasury, a spokesperson for the regulator added by electronic mail.

Non-public messaging providers within the UK have been underneath scrutiny for some time. The FCA issued a publication in January 2021 on the necessity for messaging apps to be monitored. The UK monetary regulator was quizzing banks about WhatsApp use final 12 months though a full-blown probe wasn’t in place on the time and the watchdog hasn’t but disclosed any fines.

Article content material

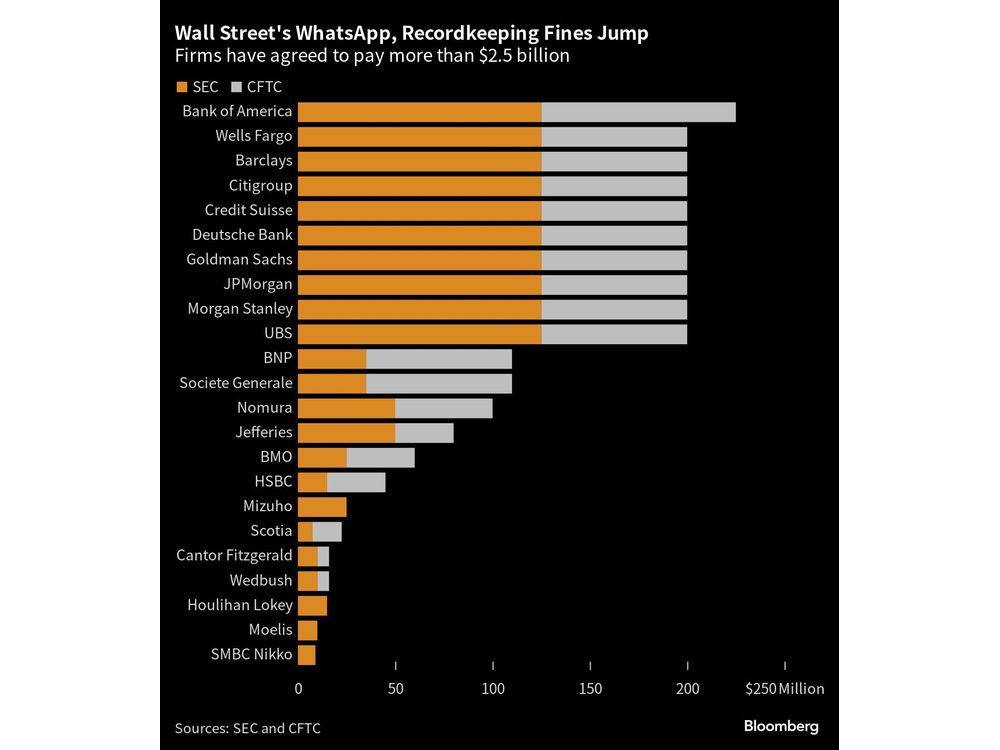

Within the US, whole fines involving such probes have now exceeded $2.5 billion since December 2021, making this one of many greatest monetary enforcement efforts of the previous decade. This month three Wells Fargo & Co. items agreed to pay a complete of $125 million to the Securities and Change Fee, whereas BNP Paribas SA can pay $35 million.

Monetary corporations are required to watch and save communications involving their enterprise to move off improper conduct. After they don’t, regulators say it’s considerably tougher to research wrongdoing. Their work is made much more troublesome when bankers use messaging instruments that delete communications routinely.

Learn Extra: Wall Avenue Hires WhatsApp Cops as US Blasts Bosses Who Textual content

The UK has now joined US regulators in clamping down on banks’ failure to document and retain information of digital communications between merchants. What started as a take a look at buying and selling desks’ use of chat apps has expanded into a glance into all of finance’s use of any form of communication instrument that doesn’t archive transcripts appropriately.

Hedge funds and personal fairness corporations are additionally underneath investigation for his or her use of private communication apps.

—With help from Tom Metcalf.

(Updates all through with additional context.)

Source link