59% anticipating a detrimental influence, survey says

Article content material

The Bank of Canada‘s latest interest rate hike — the tenth improve to its key in a single day price since 2022 — is including much more strain on Canadians already struggling to maintain up with the cost of living.

Commercial 2

Article content material

Article content material

Three-in-five (59 per cent) expect the speed improve to have a detrimental influence on their funds and one-third (34 per cent) are bracing for “important” challenges, according to a new survey by the Angus Reid Institute, which polled 1,600 Canadian adults.

These paying a mortgage are experiencing the direct influence of accelerating rates of interest, with almost two-in-five (37 per cent) having hassle making their funds. 9 in 10 mortgage-holders (89 per cent) are anticipating the newest improve will additional exacerbate this ache.

Among the many half (51 per cent) who discover their present mortgage funds “manageable,” a majority (60 per cent) concern the speed hike will hinder their potential to maintain funds on this snug zone going ahead.

Commercial 3

Article content material

It’s not simply owners who’re discovering it tough to maintain up with their funds. A fair bigger variety of renters (45 per cent) are struggling to pay their month-to-month lease, with two-thirds (63 per cent) anticipating their funds to worsen from the speed improve.

In contrast to owners, renters are confronted with the oblique influence of the central financial institution’s coverage selections as landlords cross on their elevated mortgage prices to tenants. Competitors for leases can be elevated as potential homebuyers delay purchases and anticipate rates of interest to settle.

Because of this, enthusiasm for price hikes is diminishing, with the proportion of Canadians who need charges to fall almost tripling since Might 2022.

However Canadians are nonetheless divided on how the Financial institution of Canada ought to proceed with rates of interest for the remainder of the 12 months.

Article content material

Commercial 4

Article content material

The most important group (36 per cent) desires governor Tiff Macklem to decrease charges, up 13 factors since September 2022, when the coverage price was 3.25 per cent. One-in-three (32 per cent) need him to carry the present price at 5 per cent to additional assess its influence. And a handful of Canadians (11 per cent) need to see charges rise additional to bring down inflation.

The cruel financial actuality of excessive inflation has half the respondents (49 per cent) scrambling to feed their households. That quantity jumps to 77 per cent amongst these dwelling in households with lower than $25,000 in annual revenue.

Total, at the very least 1 / 4 throughout all revenue brackets are discovering it arduous to maintain up with meals costs, signalling that even larger revenue households aren’t resistant to inflation.

Commercial 5

Article content material

Many are assessing their budgets and funds as a means to deal with the fee pressures. This consists of reducing again on discretionary spending (63 per cent), journey (43 per cent), donations (40 per cent), driving (30 per cent) and even deferring their registered retirement financial savings plan (RRSP) or tax free financial savings account (TFSA) contributions (28 per cent).

Half of Canadians are delaying large purchases corresponding to a house, automobile or main equipment, and at the very least two-thirds throughout each area within the nation expect the following 12 months to be a nasty time to make these kinds of purchases.

_____________________________________________________________

Was this text forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________

Commercial 6

Article content material

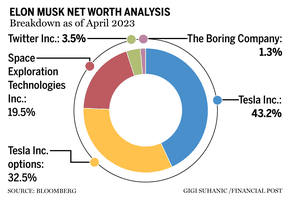

Elon Musk’s fortune slumped US$20.3 billion Thursday after Tesla Inc. warned it could must maintain reducing the costs of its electrical automobiles, sending shares tumbling. The drop in web price to US$234.4 billion additional narrows the wealth hole between Musk and Bernard Arnault, the world’s two richest individuals, based on the Bloomberg Billionaires Index. Musk’s fortune nonetheless exceeds that of Arnault, chairman of luxurious items maker LVMH, by about US$33 billion.

___________________________________________________

- At the moment’s information: Canadian retail gross sales, new housing worth index

- Earnings: American Categorical Co., Schlumberger Ltd., AutoNation Inc.

___________________________________________________

Commercial 7

Article content material

_______________________________________________________

____________________________________________________

It’s vital to file your tax return on time, whether or not you’re a person taxpayer or submitting on behalf of your company. Failure to take action can result in late-filing penalties and arrears curiosity. Tax professional Jamie Golombek examines a latest case involving a late-filed corporate tax return the place a enterprise proprietor misplaced his bid to overturn late penalties and curiosity.

Commercial 8

Article content material

-

The only inflation left is being caused by Bank of Canada

-

Why higher interest rates could be bad for workers

-

Federal Reserve interest rate hike forgone conclusion

____________________________________________________

At the moment’s Posthaste was written by Noella Ovid, with further reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? E mail us at posthaste@postmedia.com, or hit reply to ship us a notice.

Hearken to Right down to Enterprise for in-depth discussions and insights into the newest in Canadian enterprise, obtainable wherever you get your podcasts. Try the newest episode under:

Article content material

Source link

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We now have enabled electronic mail notifications—you’ll now obtain an electronic mail in case you obtain a reply to your remark, there’s an replace to a remark thread you observe or if a person you observe feedback. Go to our Community Guidelines for extra data and particulars on find out how to alter your email settings.

Be a part of the Dialog