The $9 trillion of Chinese language native authorities bonds that helped drag the remainder of the world out of the 2008 monetary disaster are a rising threat this time round.

Article content material

(Bloomberg) — The $9 trillion of Chinese language native authorities bonds that helped drag the remainder of the world out of the 2008 monetary disaster are a rising threat this time round.

Commercial 2

Article content material

The bonds funded an financial increase in China greater than a decade in the past, as native authorities borrowed closely to spend money on every little thing from roads to subways. However one in all China’s greatest state-run buyers suggested asset managers overseeing its cash to promote among the debt, Bloomberg Information just lately reported, intensifying stress on the securities.

Article content material

It’s left authorities with the difficult balancing act of defusing an enormous threat to the nation’s lenders with out triggering defaults and destabilizing the monetary system. Any implosion of bonds from native authorities financing autos would ripple by means of the native banking system, additional pressuring total development within the second largest economic system on the planet.

Goldman Sachs estimates that 34 trillion yuan ($4.75 trillion) of native authorities debt sits on the stability sheets of banks it covers. The potential headwinds to development would hit an economic system whose restoration after the pandemic has already been comparatively tepid.

Article content material

Commercial 3

Article content material

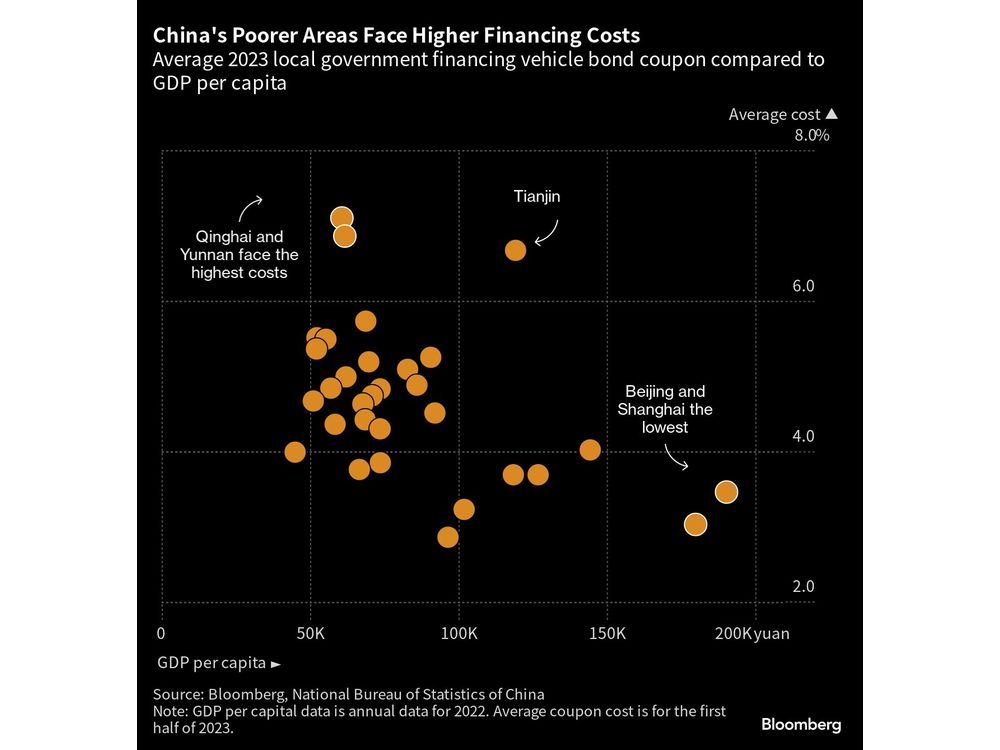

The elevated threat is highlighted by the bounce within the common coupon on LGFV yuan bonds to 4.39% within the first six months of the 12 months from 3.94% final 12 months even if China is easing financial coverage.

‘Far-Ranging Affect’

“The direct impression of LGFV default could be borne virtually utterly by home buyers, however the oblique impression needs to be far-ranging,” mentioned Brock Silvers, managing director at personal fairness agency Kaiyuan Capital. “If China’s downturn ultimately runs longer or deeper as a result of the previous playbook has lastly expired, the impression of LGFV profligacy will then be felt on a world financial scale.”

The newest developments add to hurdles for strained native governments in China. A nationwide property stoop slashed their revenue from land gross sales whereas public spending jumped throughout the pandemic.

Commercial 4

Article content material

In a survey printed final month, buyers throughout Asia mentioned the ballooning ranges of municipal borrowing was the area’s primary monetary threat this 12 months. One of many considerations is that the cash raised by the LGFVs was used on initiatives that usually don’t earn sufficient returns to cowl their money owed, leaving many reliant on refinancings or injections of presidency money to remain afloat.

Including to the difficulties, many LGFVs have been primarily shut out of the free commerce zone bond market after latest steerage from the Folks’s Financial institution of China, a major blow to the autos as a result of they have been essentially the most prevalent issuers of these securities.

Tight Grip

The steerage reveals that Beijing “continues to carry a decent grip on native debt dangers and so they wouldn’t desire a financing channel that lacks regulatory oversight,” mentioned Sherry Zhao, senior director, worldwide public finance at Fitch Rankings.

Commercial 5

Article content material

It’s additionally left issuers from poorer provinces specifically with fewer financing choices at a time when buyers are souring on threat. That’s left them going through greater borrowing prices simply as the typical maturity for onshore LGFV bond issuance falls to the bottom for the reason that information sequence started in 1999, reinforcing the stress on regulators to defuse the difficulty.

“As you get nearer and nearer to the middle of China’s authorities ensures, LGFVs are proper there on that border line,” mentioned Logan Wright, head of China markets analysis at Rhodium Group LLC in New York. “They’re necessary as a result of should you begin questioning the dedication to LGFVs, then what else are you questioning authorities credibility to defend?”

Week in Assessment

Commercial 6

Article content material

- A few of the greatest US regional banks could must concern $168 billion of bonds on the degree of their holding firms to adjust to the Fed’s plan to spice up capital necessities for lenders, in keeping with Bloomberg Intelligence.

- US leveraged mortgage costs rose to the very best degree since August as consumers concentrate on the secondary market whereas new issuance stays comparatively subdued.

- A kind of refinancing transaction is resurging within the $1.3 trillion marketplace for collateralized mortgage obligations, an indication the trade is therapeutic as considerations over surging inflation and a possible recession abate.

- BC Companions and a bunch of collectors of Keter Group BV have agreed on a deal to increase debt maturities for the maker of backyard furnishings, shopping for time for the personal fairness agency to promote the corporate and pay them again.

- Worries round debt repayments and stretched funds in billionaire Anil Agarwal’s Vedanta Sources Ltd. are as soon as once more in focus, underscored by losses in some bonds of the commodity big.

- At the very least two holders of a Sino-Ocean greenback word mentioned they didn’t obtain curiosity due July 13, the primary of practically $380 million of bond obligations this quarter for the in-focus Chinese language developer.

- Personal fairness agency Carlyle Group is alleged to be leaning towards handing over portfolio firm Praesidiad Group Ltd. to a bunch of collectors as a part of a debt restructuring.

Commercial 7

Article content material

On the Transfer

- Blackstone Inc. is hiring Max Besong, world head of collateralized mortgage obligations buying and selling at JPMorgan Securities, in keeping with individuals with data of the matter.

- Boutique funding banks and legislation corporations in Brazil are hiring as demand for recommendation on debt restructurings booms in Latin America’s greatest economic system. Moelis & Co. employed three individuals this 12 months for its Sao Paulo workplace, which has about 20 workers whole. And Houlihan Lokey Inc. employed banker Bruno Baratta from Lazard Ltd. to start out an workplace in Sao Paulo, the place he’s constructing an preliminary staff of about 10 individuals.

- Omar Chaudhry, who spearheaded buying and selling of collateralized mortgage obligations at BNP Paribas SA, has just lately exited the French lender, in keeping with individuals with data of the matter.

- Constancy Investments has employed Adam Russell as a fixed-income dealer in Canada, in keeping with individuals acquainted.

—With help from Wei Zhou, Taryana Odayar and Dan Wilchins.

Article content material

Source link

Feedback

Postmedia is dedicated to sustaining a full of life however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We’ve got enabled e-mail notifications—you’ll now obtain an e-mail should you obtain a reply to your remark, there’s an replace to a remark thread you observe or if a person you observe feedback. Go to our Community Guidelines for extra data and particulars on learn how to regulate your email settings.

Be a part of the Dialog