Article content material

(Bloomberg) — The Philippines’ new central financial institution head is pushing for lenders’ disclosure of climate-related property, pledging that the Southeast Asian nation’s banking system will be part of the worldwide efforts to gradual local weather change.

Article content material

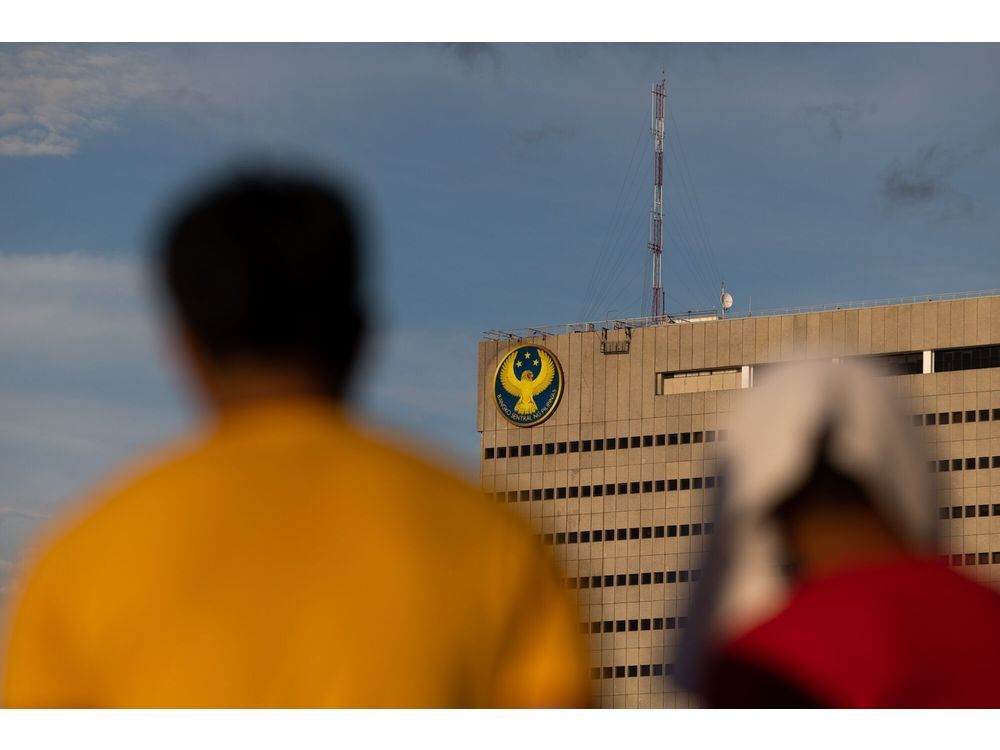

Bangko Sentral ng Pilipinas Governor Eli Remolona mentioned the financial authority is working with scientists to develop a metric for banks’ climate-related property, which can be used to attain banks by way of their function in combating local weather change.

Article content material

“We have a look at every form of mortgage or asset and what it’s financing, and determine what it’s doing for local weather change: is it slowing down or accelerating local weather change?” Remolona mentioned in a live-streamed speech at an financial briefing in Canada, considered one of his first addresses earlier than a global viewers as new central financial institution chief.

The central financial institution will make the banks’ scores public, and can ask lenders to additionally disclose their property, Remolona mentioned. “We hope that the disclosure alone will do the trick.”

Article content material

Numerous Philippine banks are already taking steps to assist fight local weather change, with some together with Financial institution of the Philippine Islands and Rizal Business Banking Corp. making time-bound commitments to zero out their excellent coal power mortgage portfolio whereas seeking to bolster renewable power lending.

Central financial institution policymakers world wide have not too long ago spotlighted local weather change and power transition amid unstable power costs and extra frequent excessive climate occasions. The Philippines, probably the most susceptible nations to the influence of local weather change, has set a purpose to chop greenhouse fuel emissions by 75% by the tip of the last decade from 2020 ranges.

In the identical speech, Remolona additionally mentioned the BSP is “decided” to carry inflation again to its 2%-to-4% goal vary. Headline inflation will possible fall inside that purpose by the fourth quarter, and “will overshoot on the low aspect” early subsequent 12 months earlier than settling again to the goal vary, he added.

Source link