Japanese issuers have bought report quantities of yen sustainable bonds at a quicker tempo than different areas this 12 months, as a deliberate debut atmosphere be aware sale by the federal government highlights its dedication to such fundraising.

![g({ijww1n198kpq7u]pvv411_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/06/sales-in-japan-of-sustainable-bonds-hit-a-record-in-first-ha.jpg?quality=90&strip=all&w=288&h=216&sig=6oAXJJSLFmlHQu3_O9YQ5A)

Article content material

(Bloomberg) — Japanese issuers have bought report quantities of yen sustainable bonds at a quicker tempo than different areas this 12 months, as a deliberate debut atmosphere be aware sale by the federal government highlights its dedication to such fundraising.

Commercial 2

Article content material

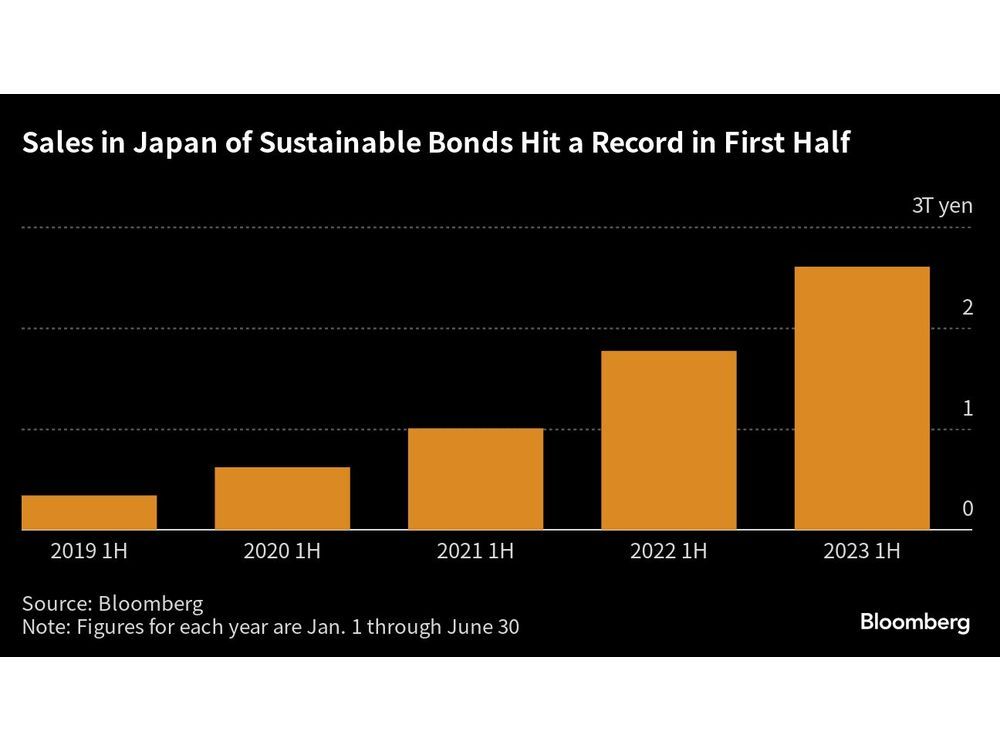

Issuance of environmental, social and governance bonds from Japanese company and government-affiliated issuers has soared 47% to 2.6 trillion yen ($18 billion) to date within the first half, essentially the most ever for the interval, Bloomberg-compiled information present. That’s quicker than the 14% enhance in world sustainable be aware gross sales through the interval and in addition beats the remainder of Asia, the US, and EMEA, the info present.

Article content material

Japan’s authorities is getting ready to concern the world’s first sovereign transition bonds within the second half of the fiscal 12 months began in April, displaying its assist for debt that’s designed to assist heavy-emitting industries change into extra vitality environment friendly and scale back their greenhouse gasoline emissions. The nation’s issuers are additionally steadily boosting the portion of their bond gross sales which are ESG debt—they made up 31% of issuance to date this 12 months, in contrast with 10% for all of 2020, in keeping with Bloomberg-compiled information.

Commercial 3

Article content material

“The federal government’s sovereign transition bond will possible increase ESG bond gross sales much more,” stated Kentaro Mori, managing director at Nomura Securities Co.’s sustainable finance division, including that transition finance within the vitality sector could proceed to develop.

Japanese sellers of transition notes this 12 months embrace Osaka Gasoline Co. with a 35 billion yen deal, and Japan Airways Co., which issued 20 billion yen of the debt. The pipeline for the nation’s ESG bonds features a mammoth deliberate inexperienced bond deal from NTT Finance Corp. of about 300 billion yen and Kyushu Railway Co.’s proposed 10 billion yen inexperienced be aware.

Article content material

Source link

Feedback

Postmedia is dedicated to sustaining a energetic however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. Now we have enabled e mail notifications—you’ll now obtain an e mail in case you obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a person you comply with feedback. Go to our Community Guidelines for extra info and particulars on regulate your email settings.

Be a part of the Dialog