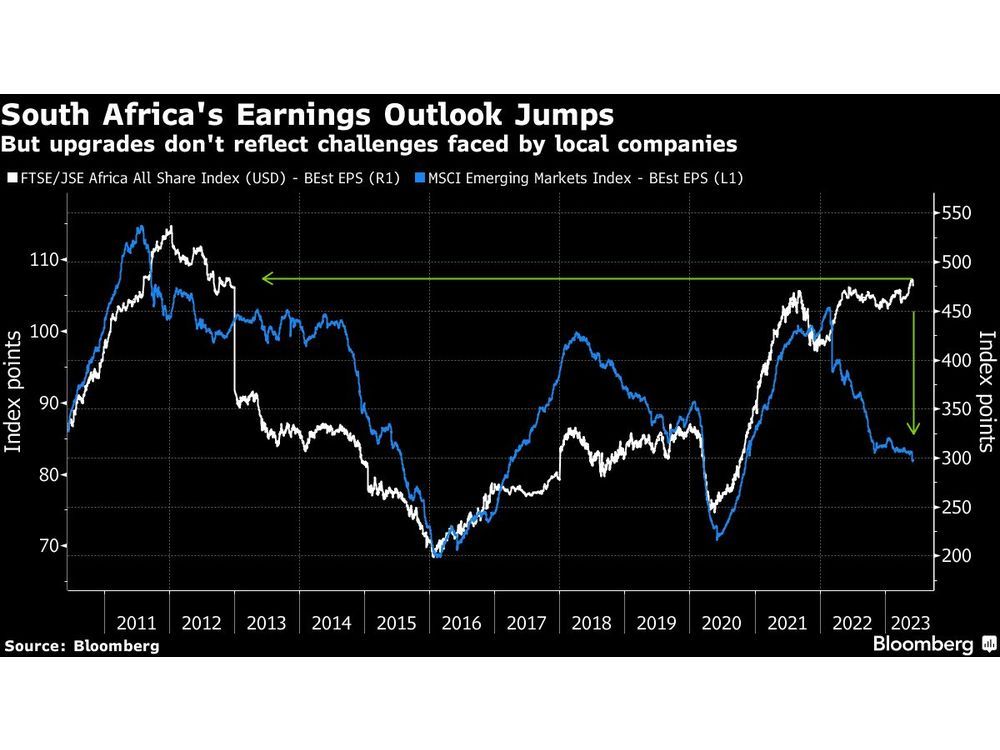

Analysts have raised the earnings outlook for South Africa’s foremost fairness index to an nearly 11-year excessive. Cash managers say that’s a purple herring.

![1)99w]qs)zz)o]r4effmu]qz_media_dl_1.png](https://smartcdn.gprod.postmedia.digital/financialpost/wp-content/uploads/2023/06/south-africas-earnings-outlook-jumps-but-upgrades-dont-refl.jpg?quality=90&strip=all&w=288&h=216&sig=NPkdX4g6UxFvBOEOVLuyaA)

Article content material

(Bloomberg) — Analysts have raised the earnings outlook for South Africa’s foremost fairness index to an nearly 11-year excessive. Cash managers say that’s a purple herring.

Commercial 2

Article content material

The common forecast for 12-month earnings within the FTSE JSE Africa All Share Index rose as a lot as 4% in greenback phrases this yr by Could 31 to the very best stage since 2012. It additionally hit a report excessive in local-currency phrases. The upgrades got here even because the estimate for emerging-market shares as a complete fell 1.4%.

Article content material

However on account of a quirk within the South African benchmark, which incorporates many international corporations, the revenue projections lean closely on progress prospects outdoors the nation — starting from luxurious items gross sales in Asia to digital commerce in Europe. Some smaller earnings upgrades replicate a rally in gold. Past this optimistic facade, South Africa’s financial system stays crippled by vitality shortages and elevated inflation, mentioned Ashish Chugh, a cash supervisor at Loomis Sayles & Co. in Boston.

Article content material

Commercial 3

Article content material

“This analyst optimism is misplaced and embeds higher-than-reasonable expectations for restoration from the extreme electrical energy rationing that’s been hitting the financial system for the previous two years,” Chugh mentioned in emailed feedback. “We’re much less sanguine on the outlook for home earnings restoration in South Africa and count on incremental downgrades from right here.”

South Africa has confronted rolling blackouts because the closely indebted state-run vitality utility struggles to maintain its getting older fleet of energy stations working. In the meantime, inflation is operating properly above the central financial institution’s goal vary, prompting it to greater than double its benchmark price to eight.25% in two years in an extra constraint on the financial system. The South African Reserve Financial institution minimize its financial progress outlook for 2023 to 0.3%, whereas the Worldwide Financial Fund projected a 0.1% growth.

Commercial 4

Article content material

Chugh mentioned corporations with companies overseas and that don’t rely upon the home financial system account for nearly half of the primary Johannesburg fairness index by weight. A lot of the market’s restricted funding attraction comes down to those shares, however they’re a guess on choose corners of the worldwide financial system, fairly than on South Africa.

Richemont, the Swiss luxurious conglomerate, is the single-biggest inventory within the South African index, with a weighting of about 19%. Earnings projections for the Cartier proprietor have climbed 16% this yr, pushing them to a report excessive in information going again to 2005.

Different international corporations akin to Amsterdam-based tech investor Prosus NV and British American Tobacco Plc have additionally had their earnings outlook upgraded. And estimates have been raised for Gold Fields Ltd., Concord Gold Mining Co. and DRDGold Ltd., helped by bullion’s 7.7% advance in 2023.

Commercial 5

Article content material

In the meantime, earnings expectations for many domestically targeted corporations have been heading decrease.

“Over the previous couple of months, a divergence in earnings expectations has been growing,” mentioned cash managers Hannes van den Berg and Rehana Khan on the Ninety One Fairness Fund. “Issues round disruptive electrical energy provide in addition to tighter financial situations have seen expectations for SA Inc. corporations moderating.”

READ MORE: How South Africa’s Blackouts Went From Unhealthy to Worse: QuickTake

This yr’s 5.3% acquire within the Johannesburg benchmark index has been nearly solely pushed by corporations with their main listings overseas, leaving domestically targeted companies lagging behind. Zurich-traded Richemont’s greater than 30% surge accounts for 90% of the gauge’s efficiency, adopted by the gold corporations with smaller contributions.

Commercial 6

Article content material

Cash managers predict index-level good points to wind down this yr.

“Sustaining the restoration is more likely to be difficult till the South African Reserve Financial institution begins to chop rates of interest, loadshedding is considerably decreased, the financial system returns to actual progress and the worldwide macro atmosphere turns into extra supportive,” mentioned Peter Takaendesa, the top of equities at Mergence Funding Managers in Cape City. “We don’t forecast short-term returns for the fairness market, however deal with discovering high quality enterprise that commerce at cheaper valuations in comparison with our evaluation of their long run intrinsic values.”

Article content material

Source link

Feedback

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback could take as much as an hour for moderation earlier than showing on the positioning. We ask you to maintain your feedback related and respectful. We have now enabled e-mail notifications—you’ll now obtain an e-mail when you obtain a reply to your remark, there’s an replace to a remark thread you comply with or if a person you comply with feedback. Go to our Community Guidelines for extra info and particulars on how you can regulate your email settings.

Be part of the Dialog