Article content material

(Bloomberg) — Are we there but? This week may lastly see the height of the US interest-rate mountain and, fingers crossed, the final fire-sale for a US financial institution within the newest disaster. But manufacturing knowledge from China suggests the worldwide restoration nonetheless has a protracted solution to go.

Article content material

The massive peak: The Fed will announce its newest charge determination on Could 3, with most economists anticipating a closing 25-basis-point hike for this cycle. However with inflation nonetheless working at greater than double the central financial institution’s 2% goal, it could be subsequent 12 months earlier than charges begin coming down once more. The next day, the European Central Financial institution may even most likely add 1 / 4 level, assuming inflation knowledge on Could 2 isn’t unexpectedly sturdy. The US April employment report is predicted to point out a payroll achieve of about 180,000, lower than the prior month, with unemployment at round 3.6%.

Article content material

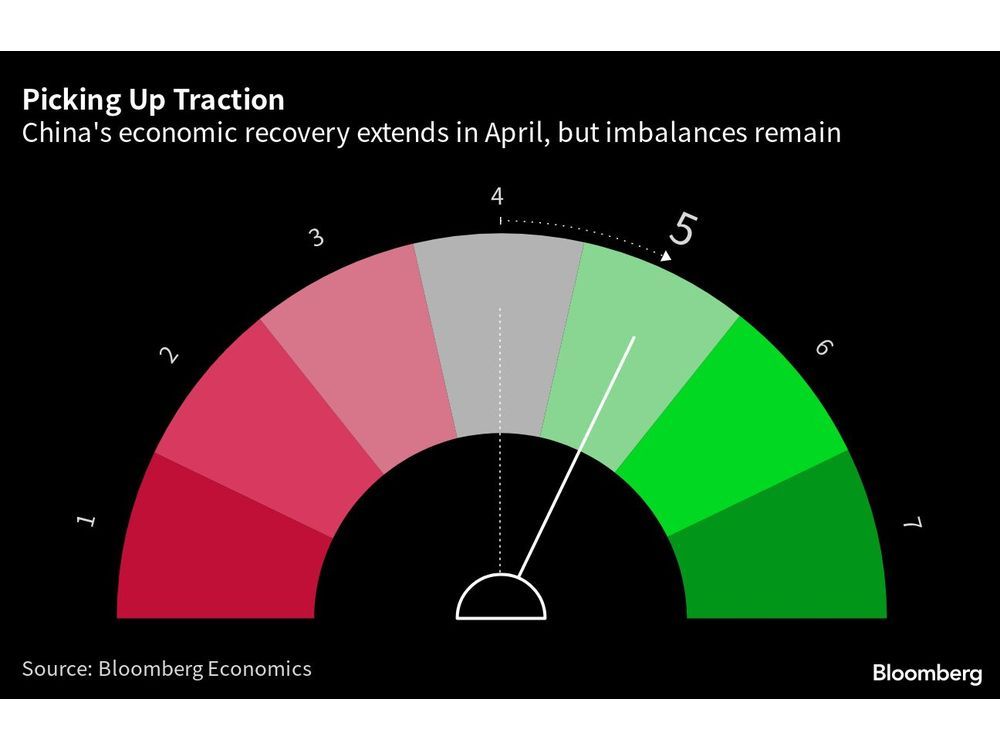

The massive knowledge: China’s PMIs immediately disenchanted, with each manufacturing and providers gauges coming in worse than anticipated. Fee selections embody the Reserve Financial institution of Australia on Tuesday, and Financial institution Negara Malaysia on Wednesday, with each anticipated to carry. We’ll get inflation knowledge from Thailand, the Philippines and Indonesia, with the latter additionally reporting progress figures for the primary three months of the 12 months.

Article content material

The massive public sale: The Federal Deposit Insurance coverage Corp. has requested JPMorgan, PNC, US Bancorp, Financial institution of America and anybody else who’s to submit closing bids for First Republic Financial institution by immediately, which was final valued at simply $650 million after its share value collapsed 97% this 12 months.

The massive earnings: Asia’s massive banks are in focus this week, with HSBC, Macquarie and DBS all prone to sign stronger lending because the area’s central banks head to the tip of the present rate-hike cycle. Indian billionaire Gautam Adani’s corporations together with Adani Inexperienced Power and Adani Ports may even report earnings after the primary debt buyback because it was focused by a brief vendor in January.

The massive bling: Squid Sport’s Hoyeon Jung was the primary mannequin on the runway final night time as Louis Vuitton showcased its pre-autumn ladies’s assortment on Seoul’s Jamsugyo bridge. LV made greater than $1 billion in gross sales in South Korea final 12 months and is attempting to leverage the recognition of Okay-pop and Korean TV, which has armies of followers worldwide.

The massive gathering: The Nineteen Eighties junk bond king turned Twenty first-century philanthropist Michael Milken is as soon as extra bringing collectively 3,500 bankers, buyers and authorities leaders on the Beverly Hilton in California for the most recent version of the Milken Institute World Convention, optimistically entitled “ Advancing a Thriving World.” The view from Beverly Hills have to be just a little totally different.

And at last, as we sit up for every week that gives a mix of hope and gloom, it’s good to know that a minimum of one individual has lastly made it to the highest.

Have a regal week.

Source link